yext

Preferred Rate - Burr Ridge Owner verified

11S230 Jackson St. Unit 101 Burr Ridge, IL, 60527Last time updated: 12/31/25, 3:44 PM

About

Preferred Rate is the trusted, local APM division that caters to the specific needs of your community. Preferred Rate's mission is to create experiences that matter while serving your home financing needs. Whether you are buying your first home, a new investment property or building your dream home. Preferred Rate will empower you with confidence, knowledge and solid expertise from loan application through closing.

Images

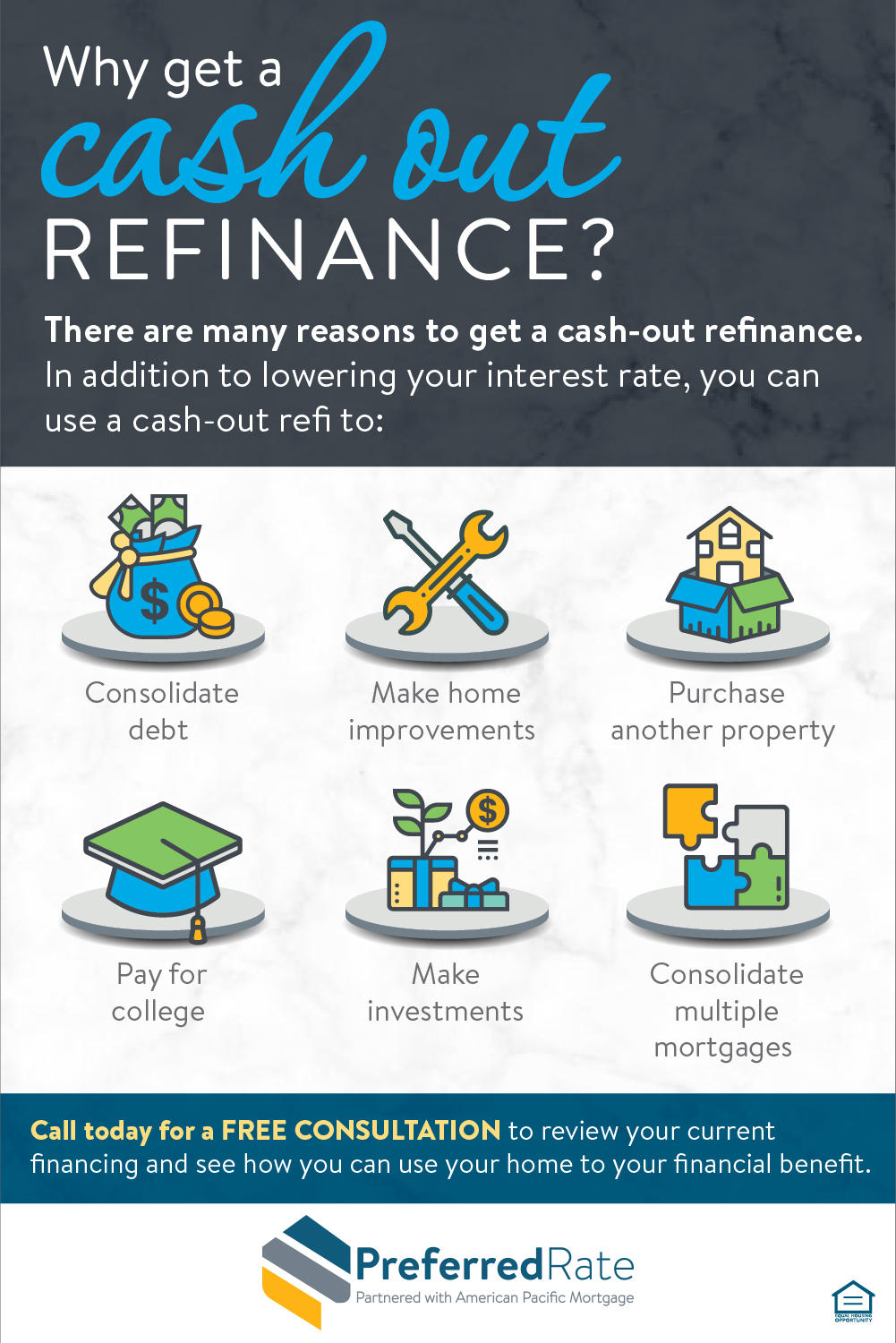

Circumstances change - financial objectives change - your mortgage might need to change as well! Let's schedule a quick review of your current financing and financial situation and goals and ensure you have the right loan to get you where you want to be!

If you are considering refinancing, or just want more information, please reach out to us today!

At Preferred Rate, we can help you dream B-I-G with JUMBO home financing!

Our competitive rates and flexible loan options can help you purchase or refinance your dream home.

Preferred Rate Jumbo Home Financing Includes:

❇️ Loan amounts up to $1.5 million

❇️ No mortgage insurance

❇️ Down payments as low as 10%

If you're ready to think B I G when it comes to your home, connect with a Preferred Rate Mortgage Advisor at www.preferredrate.com!

There are some F A C T O R S that can drive interest rates down and into favorable positions for those looking to buy a home or refinance. ⬇️

These factors include:

✳️ The assumption that the Fed will continue to keep short-term rates, or the federal funds rate, low. (2020)

✳️ A slow housing market and lower demand for mortgages. (2010-2016)

✳️ Declining economy—lower employment levels and lower wages usually lead to lower interest rates. (2020)

✳️ The stock market moves to very low levels, driving bond prices higher and rates lower. (2020)

As you can see, 2020 has been a combination of several FACTORS that have moved rates downward to some of the lowest levels in history, which may provide opportunities for homeowners and those looking to buy. An annual mortgage checkup may help you identify an opportunity for your individual circumstance or financial goals. All you have to do is visit www.PreferredRate.com to schedule your FREE, no-obligation mortgage checkup call. 📍

A pre-approval letter is generally good for 60 to 90 days, giving you plenty of time to shop for your new home. Once your advisor understands what your end goal is, they will help you map out a plan to get to the finish line.

Visit www.PreferredRate.com to locate a Mortgage Advisor near you and get started today! 📍

Would you like to buy a home, but you’re worried about your credit? Your credit score is important, but there are ways to improve it.

The path to homeownership starts with a plan. Let’s make one for you!

The good news is buying a home doesn’t have to be overwhelming as long as you take these proactive steps.

At Preferred Rate, we've got you covered! We understand that times are complicated, and to ensure both the safety of our team and our clients, we offer a ZERO CONTACT application process.

If you're looking to purchase your dream home or to refinance, reach out to us today!

There's a lot happening in the market right now and if you have questions, Preferred Rate is here to help!

Our Mortgage Advisors are working overtime to answer all of your questions to help guide you in the right direction and support your financial needs.

If you have any questions, please don't hesitate to reach out to us.

The STaR loan program is dedicated to serving our selfless medical workforce for all that you do for our community. We will make the process of obtaining a mortgage a little bit easier while saving you money along the way.

Contact us today to learn more about this exciting program!

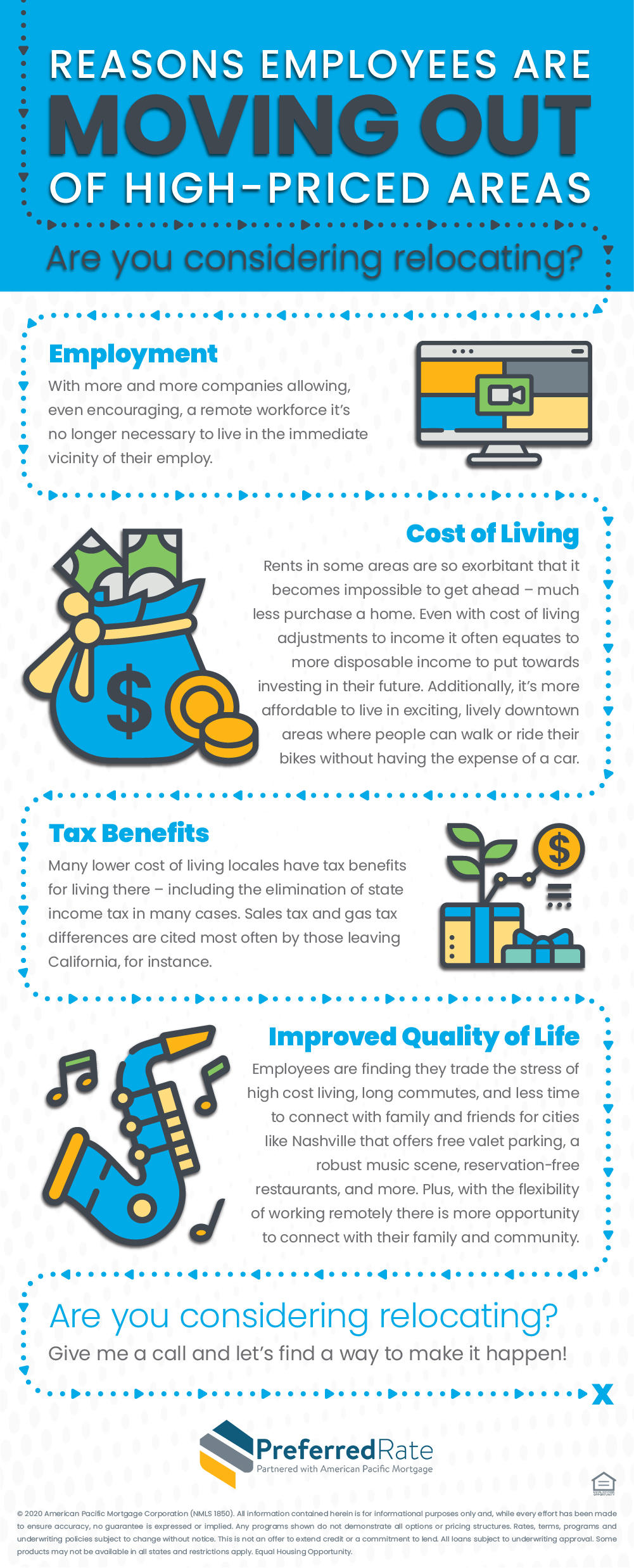

An accessory dwelling unit, or ADU, is a fancy phrase for a smaller stand-alone space on your property. They’re oftentimes referred to as guest houses, granny flats, or even pool houses. These modest spaces are functional, livable, and super convenient if you need more R O O M but don’t feel like packing up and moving into a new home entirely. 🤔

The reasons to build an accessory dwelling unit are almost as diverse as the units themselves. Maybe your home feels {{cramped}} now that you’re trying to work from home while your kids are homeschooling. Maybe you have parents or in-laws who are at that stage where they need a little help but aren’t ready for an assisted living facility. The same can be true of college students or adult children who need to save money or perhaps have encountered some career or financial obstacles.

Curious about ADUs? Reach out to us today for more information!

Is your home <> on space? Is every square foot being used and there STILL isn’t enough room to accommodate life as we know it today?

Maybe you had to give up your guest room to create a space for homeschooling or an office or you’re considering an office outside of the home. You’ve been looking for a new home online, but with inventory low, ⬇️ you’re not sure that is the best option.

If the answer to any of these scenarios is yes, you may want to consider an accessory dwelling unit (ADU), also commonly known as a guest house or granny suite, to give yourself a little more S P A C E.

If allowed within your city limits, an ADU is a great option for expanding and creating more space on a reasonable budget. An ADU:

➡️ Increases your property’s value in many instances.

➡️ Could be used for rental income or for private guest accommodations in the future.

➡️ Offers affordable but independent, private living.

➡️ Helps solve the housing shortage crisis and reduces the carbon footprint of a new home.

Be sure to do your research before you get started. ADU laws vary widely, and there may be tax implications, so make sure to check with your city planning office before you start making plans.

If you need help leveraging your home equity to bring your vision to life, go to www.PreferredRate.com to connect with a Preferred Rate Mortgage Advisor near you.

If multigenerational living is NOT for you and your family, and you’re seeking housing options for a member of your family (a college student or parent in need of a low-maintenance place to live), leveraging your home equity to buy (or help buy) another home might be an O P T I O N to consider.

Many people have seen their home equity go up ⬆️ ⬆️ ⬆️ substantially in recent years. If you have enough equity in your home, you may be able to use it towards a down payment on another home.

In fact, you have in your current home might be the least-expensive option in your toolkit.

✳️ Lower interest rates than other options

✳️ You don’t have to divert money from existing investments

✳️ You can tap into your net worth in a way that’s difficult to access otherwise

Either a home equity loan or a refinance can help you T-A-P your home equity and give you the cash you need to buy a home or make a substantial down payment on one. If you’d like to start exploring this process, visit www.PreferredRate.com to connect with a Preferred Rate Mortgage Advisor near you.

The #pandemic has changed everything, and one of the biggest is the demands placed on our homes. Whether it's a need for office/school space, children returning home to save money, or family moving in as an alternative to a nursing home, we're here to help find the solution!

Are you R E A D Y to be a homeowner? We have programs like HomeReady to help make it happen!

What if you could get a loan approval in HOURS instead of days? Imagine the BOOST that would give to your offer to purchase a home! Our loan approval process has been streamlined and automated to give you just the boost you need to get you into your next home! Let's chat.

It’s not just a pipe dream, we are here to get you started. We know the ins and outs of the process and it's a great time to learn more about building your next home. Give us a call to learn about the Preferred Rate advantage.

There are several economic factors that influence interest rates and can cause them to rise and fall. When we have a strong and thriving economy, inflation tends to follow and normally comes with an uptick in rates. But that's not it - let's connect and we'll you more!

Frequently Asked Questions

When was Preferred Rate - Burr Ridge founded?

Preferred Rate - Burr Ridge was founded in 2012.

Which days is Preferred Rate - Burr Ridge open?

Open on Monday, Tuesday, Wednesday, Thursday, Friday, Saturday.

What are Preferred Rate - Burr Ridge main products?

30-Year Fixed Rate Mortgage, 15-Year Fixed Rate Mortgage, Adjustable Rate Mortgage, Interest-Only Loan (refinance), Jumbo Loan, FHA Loan, USDA Loan, Reverse Mortgage Loan (refinance), VA Loan, Bridge Loan, Renovation Loans, Fannie Mae HomeStyle, Home Possible Advantage by Freddie Mac.

What are Preferred Rate - Burr Ridge main services?

Home Financing, Mortgage Refinance.

Attention business owner!

Register your business now and enhance your global reach with iGlobal.

Copied to clipboard!