yext

Baker Business and Tax Services LLC Owner verified

20 N Grand Ave UNIT 6 Fort Thomas, KY, 41075Last time updated: 3/3/26, 5:07 PM

About

Since 2019, Baker Business and Tax Services has been the trusted financial partner for individuals and small to medium-sized businesses. Located in Fort Thomas, Kentucky, our team of dedicated professionals specializes in a comprehensive suite of services. From expert tax preparation and certified public accounting to meticulous bookkeeping and efficient payroll services, we provide the financial clarity you need. We also offer specialized consulting to guide you through LLC and S-Corp setups, ensuring your business is structured for success and sustained growth.

From the tiniest detail, to the highest overall view, our goal is to help you stay tax-compliant, while also ensuring you stay efficient with your tax dollars.

Images

January 15th is the deadline for 4th quarter estimated taxes, and it's just four weeks away. Mark your calendar to keep your tax preparation smooth and penalty-free. Need some guidance on quarterly taxes? We can help. Reach out and lets talk about your situation.

It's March, and the busy season is here! There are just 6 weeks until Tax Day. But you can avoid the April rush. Schedule your tax appointment now while slots are still open. Our local experts in Fort Thomas, Kentucky are ready to help file your taxes on time. Reach out and schedule your time now.

Business owners, get your payroll finalized this week if you’re sending bonuses to your employees. Having correct withholdings now, can prevent tax prep issues later. Merry Christmas from Baker Business & Tax Services in Fort Thomas, Kentucky!

Before the ball drops, wrap up last-minute tax prep items. These are things like donations, retirement contributions, and W-4 adjustments. Start 2026 ahead of the game and Happy New Year!

Tomorrow is Veterans Day. It's a time when we thank all those who served our country. 🇺🇸 Military families often can qualify for unique tax benefits. Ask us how they might apply to your tax situation. Reach out bd we can talk.

With the end of August in sight, back-to-school season is here in Cincinnati! That means it's time to buy school supplies and pay school fees. But remember, certain education expenses may qualify for tax credits when it's time to file your taxes. So, save your receipts now to make tax prep easier later.

Happy Labor Day, Cincinnati! 🇺🇸 If you’re self-employed, quarterly estimated taxes are due September 15. Staying current makes for smoother tax preparation.

Education credits, like the American Opportunity Credit (AOC) can save families money. Ask us how your school expenses can be part of your tax preparation plan and reduce your total tax bill.

Today is the deadline for 3rd quarter estimated taxes. Filing on time helps you avoid penalties and keeps your tax prep on track. Need help, let us know.

Are you thinking about making some charitable donations this fall? Giving to qualified organizations now can reduce your taxable income and simplify year-end tax preparation later. Want to learn more? Visit our website or give us a call. We can help.

If you're a small business owner, fall is a great time to review your books. Getting caught up and preparing now makes year-end tax prep faster and less stressful. If your plate is full, we can help. visit our website to learn more.

Here's a Planning Tip: When you make contributions to your retirement accounts, it may lower your taxable income and hence also lower your tax bill. Call us to learn how retirement savings can fit into your 2025 tax prep strategy.

October 15 is the deadline for tax extensions! So, if you filed for extra time, don’t wait any longer. You need to finish your tax preparation this week. We can help. Call us today to discuss your situation.

January is here. So, start the new year off right. Gather your tax documents early and let our Fort Thomas, Kentucky CPA team help you stay organized. This kind of early preparation means less stress and more savings at tax filing time. Reach out to schedule a tax appointment.

We're in the last quarter of the year, and holiday bonuses are right around the corner! Both employers and employees should plan ahead now. You don't want there to be any surprises in your year-end tax prep. We can help. Set up an appointment at our Fort Thomas, Kentucky office now to avoid any issues in tax season.

Are you thinking about making an equipment purchase for your business? Section 179 of the U.S. Tax Code allows businesses to deduct purchases, reducing your tax burden. It's an important step in year-end tax preparation. Need help understanding if your new equipment is allowed under 179? The CPAs in our Fort Thomas, Kentucky office can help.

Medicare Open Enrollment is happening now. Believe it or not, the health plan you choose can affect your taxes. By making smart choices now, you can have a smoother time with your tax preparation in 2026. We can help you pick the right plan. Reach out and we can schedule a time to discuss the options.

If you own or operate a small business, this is for you: November is the time to review your deductions and begin planning for tax season. Scheduling a year-end checkup now will make your tax preparation less stressful during tax season. We can help. Reach out and let's schedule a time to talk.

Tax season is here! W-2s are being mailed out and the IRS will open e-filing soon. Get your documents together now if you want a faster refund and easier tax preparation experience. Do you need help with your taxes this year? Reach out and let's find a time to talk.

Don't forget to keep records of your holiday donations. They may count toward deductions and help with your tax preparation in the new year. Most importantly, Happy Thanksgiving from Baker Business & Tax Services in Fort Thomas, KY!

December is here! That means we've moved into crunch time for tax preparation tasks. Don't forget to do the following before the end of the year:

✅ Max out your retirement contributions,

✅ Make and track charitable donations,

✅ Reduce your tax liability through tax-loss harvesting.

These moves can lower your tax bill. If you need additional help, reach out and lets talk about your situation.

Did you know that energy-efficient home upgrades may qualify for tax credits? These include things like heating & cooling improvements, adding insulation, installing high-performance windows and doors and improving your water heater. That means you save money on your energy bill now, and again later during tax prep time. Want to learn more? Reach out to our Fort Thomas, Kentucky office and let's talk about your situation.

The January 15th deadline for 4th quarter estimated taxes is just a few days away. So, here's some advice for freelancers and business owners: Stay current with your quarterly taxes. Doing so means you'll have a smoother time during tax prep.

Employers will start sending out tax forms this month. Get them to us, along with either your digital or paper receipts. We’ll help you track what’s deductible and what is not. We’ll help you make sure every deduction and credit is applied correctly. Staying organized now pays off during tax prep later.

Do you find it difficult to stay on top of your finances? Our bookkeeping services help you make informed decisions throughout the year, not just in the lead-up to tax time. Schedule a consultation today to learn how easy it is to simplify your books.

Filing early on in tax season means you'll feel less stress and get your refund faster. Our CPA team will help you file with confidence and take advantage of every tax break you deserve. Reach out and let's set up a time to get you started!

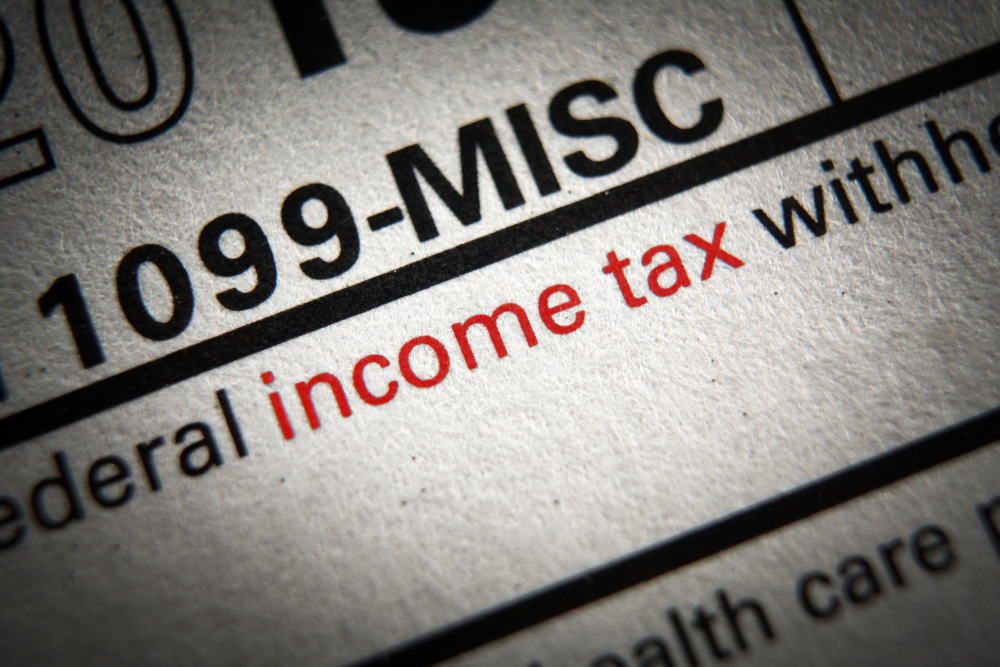

Do you hire local contractors? If you do, you’re required to file form 1099 for each one. As part of our service, we can take care of it for you! Let our experienced CPA & bookkeeping team handle your filings accurately and on time. Reach out and let's talk abut how we can help.

Nobody likes to leave money on the table. So make sure you're taking every deduction and tax credit that applies to your situation. We can help you identify those opportunities. So, make sure your tax situation is optimized. Schedule your tax prep appointment with us today.

Frequently Asked Questions

When was Baker Business and Tax Services LLC founded?

Baker Business and Tax Services LLC was founded in 2019.

Which days is Baker Business and Tax Services LLC open?

Open on Monday, Tuesday, Wednesday, Thursday, Friday.

What are Baker Business and Tax Services LLC specialties?

Tax Preparation, Bookkeeping, Payroll.

What are Baker Business and Tax Services LLC main services?

Tax Preparation, Bookkeeping, Payroll, Accounting.

Attention business owner!

Register your business now and enhance your global reach with iGlobal.

Copied to clipboard!